”Banks are not your friends, we all know that. So we decided to create a replacement for the banking system, right? Something that acts in your best interest.

A place where you can have your money work for you, not just you work for your money.”

Alex Mashinsky, CEO of Celsius Network

In a time when traditional savings accounts pay almost nothing, Celsius, a multi-billion dollar crypto bank, has been taking center stage for some time now.

With its core business strategy being to challenge conventional banking, a business notorious for paying you next to no yield on your deposits on their platform.

A noble cause, but how does Celsius aim to accomplish this difficult task? Promising interest rates as high as 18% is tens or hundreds of times the rates on traditional savings accounts.

The idea that Celsius is presenting is not out of this world. Banks do give tiny interest rates compared to what they make themselves and Celsius has been charging users who borrow their money more than they paid to the average depositor. So shouldn’t they be making a profit together with its users?

Where is the problem and why is Celsius currently facing a liquidity crisis?

Winter in June, how market cycles impact loaning.

While markets are green and your numbers are increasing by the day, opening up your portfolio is a welcome sight come each morning.

But as more than a trillion dollars in value gets wiped from the crypto markets in a mere month, withdrawing and staying away is usually the first choice for many retail investors. This leads us to the first sign of trouble.

Money seemingly goes up forever, until suddenly, it doesn’t.

Between March and May, a billion dollars flowed out of Celsius Network. A drop in the ocean for a giant such as Celsius as the million users who entrusted their life savings to them have helped the project amass more than $25 billion dollars in assets. Many users on Twitter were not satisfied though it still provides some reason to worry and many users on Twitter point out a glaring issue in the flywheel economics of its token.

As we pointed out in the beginning, Celsius charges more on the loans they issue than the interest they pay the average depositor.

So to make the most money, why doesn’t Celsius just loan out as much of their money as possible? The problem is that no bank can ever loan out 100% of what they have as deposits. The reason being if you loan out every dollar you have, you will have nothing left to pay user withdrawals with.

So you’re left with a problem:

- Lend too much and you can’t pay withdrawals.

- Lend too little and you’re losing money every month.

To make the system work more smoothly and to partially fix this issue, Celsius created and raised funding for its own token. $CEL can help provide liquidity where it’s lacking.

Unfortunately, the crypto bear market had other plans for this quick fix.

The Luna Collapse and how it indirectly shed light on the state of Celsius

Celsius is formally a CeFi company, so having a complete overview of their positions is unfeasible and it’s impossible to know what is happening internally at Celsius. Nevertheless, given the facts, it is possible to have a reasonably clear picture of the current situation. Most of the facts in this section are on-chain data.

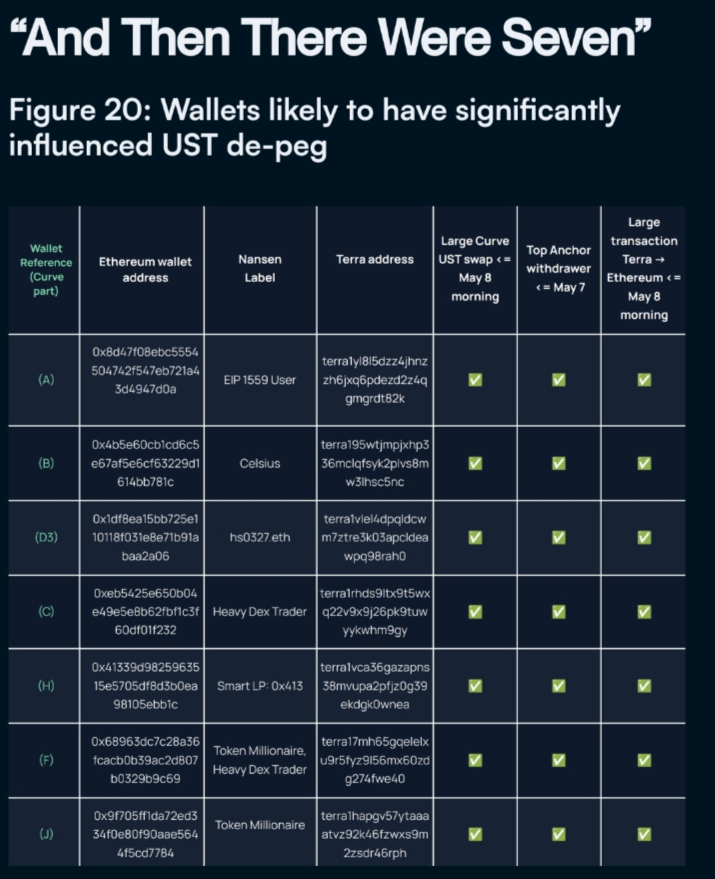

Just a month ago, Terra and their flagship product Anchor crashed after UST started de-pegging due to a couple of massive withdrawals.

One of these wallets has been found to be from Celsius Network.

With Terra selling a similar pitch, that pitch being that banks are bad and crypto stablecoins can pay way bigger interest with the same safety, all eyes shifted from Luna and were now pointing at Celsius.

The signs were starting to add up. Remember how you need some liquidity free at all times in order to pay user withdrawals? The plan at Celsius was to borrow from other sources, such as FTX, which loaned them $50 Million, then simply sell $CEL periodically and pay off their loans.

Eventually, though, the bear market started deleting the value of $CEL and slowly but surely, this plan started to crumble.

Combine this with the fact that Celsius lost millions of dollars in hacks and internal errors.

- $70m in Stakehound hack.

- $50m in Badgerdao hack.

- A massive loss in holding ETH.

- An undisclosed amount in LUNA UST crash.

These problems compound in a vicious cycle.

The more the pressure of withdrawals mounted on Celsius, the more they would take out loans to pay users their withdrawals.

This would then get captured on-chain and posted on socials for all of crypto to see and panic, which results in more people withdrawing.

This is what is known as a ‘Bank run.’ Seeing this, Celsius officially suspended all withdrawals and transfers, citing ‘extreme market conditions. ‘

Again, this caused more people to panic, further causing the $CEL token to search for lower prices and compounding the issue of the lack of liquidity even further.

Now that Celsius is trying to buy some time for themselves by pausing transfers, where can they possibly get liquidity from?

ETH, stETH and ETH2

With users withdrawing 50k ETH per week, there is a chance Celsius will become a forced seller of staked ETH in order to recover liquidity for users. This gradual event could trigger a cascading liquidation that can further damage Celsius and crypto markets.

Only 27% of ETH Celsius has in its possession is liquid, and the rest is locked up in staked ETH ($stETH).

stETH is just staked ETH represented in the form of its own token. None of the ETH liquid staking tokens (stETH, BETH, RETH, AETHC, etc.) can be redeemed until after the POS merge and after transactions are enabled on ETH2.

The nature of the merge is that there is no exact date of it happening, so it’s anyone’s guess whether Celsius will be able to redeem stETH for ETH in the next 6 months, a year, or perhaps even longer.

And to Celsius, even the most liquid options for selling stETH to ETH are unfeasible as their position is way too big to sell without crashing the market.

“If Celsius becomes a forced seller of stETH in order to recover liquidity for user withdrawals, this could perhaps be the event that triggers the liquidation cascade. In fact, even the fear of that event could be the trigger.”

Cobie, Co-Founder of Lido

Again, this is speculative. As Celsius comes from CeFi, we have no real idea of their actual financial position, what tools are available to them, what customer liabilities they have, and so on.

Conclusion and worst-case scenario

The only real way Celsius can process all withdrawals is to wait until post-merge for all their stETH to be redeemable and liquid. But it’s impossible to tell where the price of ETH will be at that moment.

Or Celsius ends up eating sizeable losses by selling all their stETH in an illiquid market. Knowing the sensitive nature of their situation, even going through OTC still forces them to sell at a considerable discount.

Rumors are already spreading that NEXO is offering a buy-out.

A glimmer of hope for every Celsius user, but if this offer is accepted, it would realize a serious loss for the company’s balance sheet. As of this moment, though, the help has been refused.

“Yesterday [June 12], we reached out to the Celsius team to offer our support, but our help was refused.”

NEXO

To summarize, Celsius has the following cards to play:

- Wait for stETH to be redeemable 1:1, which can take 6–12 months or longer.

- Forcibly sell stETH, but this realizes considerable losses and has a chance of causing cascading liquidations in the general crypto market which can further drive down prices.

- Forcibly sell OTC at significant discounts, which would mean realizing heavy losses for Celsius balance sheet.

As the story unfolds, we will write additional updates as new information is revealed.